Have you ever been intrigued by the world of cryptocurrencies but hesitated, wondering if your investments might leave a carbon footprint as hefty as Bigfoot’s?

Or perhaps you’ve been stumped by the complexities of investing in crypto and blockchain unsure of how and where to start?

This is your gateway to financial growth with a green twist. So, grab your virtual wallet, and let’s dive into the world of sustainable crypto investment! 🌱💰🌍

Is Crypto a Good Investment?

You’ve probably heard the buzz about cryptocurrencies, and you might be wondering, “Is this the golden opportunity I’ve been waiting for?” Let’s explore the ins and outs of investing in cryptocurrencies to help you make an informed decision:

- Digital Revolution: Cryptocurrencies are at the forefront of a digital revolution, offering a new way to invest and transact in the online world.

- Potential for High Returns: Some crypto stories are the stuff of legends, with early investors seeing jaw-dropping returns. Could you be next?

- Diversification: Investing in cryptocurrencies can be a valuable addition to your investment portfolio, adding a layer of diversification.

- 24/7 Market: The crypto market never sleeps, trading round the clock, giving you more flexibility in managing your investments.

- Risks and Volatility: It’s not all sunshine and rainbows. Cryptocurrencies are known for their price volatility, which can lead to both thrilling highs and nerve-wracking lows.

But, hold on a minute!

In the upcoming sections, we’ll dive into the “HOW-TOs” to navigate these price swings, ensuring you’re mentally well-prepared for the ride.

Is Cryptocurrency Sustainable for the Future?

All right, let’s get down to brass tacks. The term “cryptocurrency” gets thrown around like confetti at a parade, but what’s the deal with its long-term sustainability? Can these digital coins and blockchain technology coexist with a greener, eco-conscious future?

Blockchain: A Sustainable Game-Changer

First off, it’s essential to understand that cryptocurrencies aren’t just about financial transactions; they’re also about the technology behind them—blockchain. This revolutionary digital ledger system could be a game-changer for sustainability:

- Decentralization: Blockchain is inherently decentralized, which means no single entity has ultimate control. This democratic approach has the potential to eliminate intermediaries, reduce corruption, and democratize financial systems.

- Transparency: Every transaction on a blockchain is recorded and visible to anyone. This transparency can foster trust and accountability, whether it’s tracking the supply chain of eco-friendly products or ensuring that charitable donations reach their intended recipients.

- Smart Contracts: Blockchain enables the creation of self-executing smart contracts. These contracts could streamline and automate a wide range of processes, making them more efficient and environmentally friendly.

Environmental Concerns and Cryptos

It’s not all sunshine and rainbows, though. Cryptocurrencies, especially Bitcoin, have come under scrutiny for their energy consumption. The process of mining, essential for maintaining the security and integrity of cryptocurrency networks, can be energy-intensive.

- Proof of Work (PoW): Many cryptocurrencies, including Bitcoin, rely on a consensus mechanism called Proof of Work. Miners solve complex mathematical puzzles to validate transactions, which requires substantial computational power and, by extension, energy. This PoW system has raised concerns about its environmental impact.

- Carbon Footprint: The energy consumption associated with mining has led to debates about the carbon footprint of cryptocurrencies. Some critics argue that cryptocurrencies contribute to greenhouse gas emissions and exacerbate global warming.

Is There a Sustainable Cryptocurrency?

The good news is that crypto enthusiasts and environmental advocates are not turning a blind eye to these concerns. In fact, there’s a growing movement toward eco-friendly cryptocurrencies:

- 1. Proof of Stake (PoS): Cryptocurrencies that use PoS consensus mechanisms, like Cardano (ADA), Algorand (ALGO), and Tezos (XTZ), are considered more sustainable than those using the energy-intensive Proof of Work (PoW) system, like Bitcoin.

- 2. Eco-Friendly Initiatives: Some projects are actively addressing sustainability concerns. For example, Ethereum (ETH) is transitioning to Ethereum 2.0, a PoS blockchain, to reduce energy consumption.

- 3. Green Cryptocurrencies: There are cryptocurrencies specifically designed to be environmentally friendly, such as Chia (XCH), which uses proof of space and time (PoST) for energy-efficient mining.

- 4. Carbon Offset Programs: Some projects, like the Ripple XRP Ledger, are involved in carbon offset initiatives to balance their carbon emissions.

- 5. ESG-Focused Tokens: Environmental, Social, and Governance (ESG) criteria are increasingly important. Some cryptocurrencies are designed to align with ESG values, making them more sustainable options.

The Sustainability Outlook

So, what’s the verdict on cryptocurrency sustainability for the future? The landscape is evolving, and the journey has just begun.

It’s clear that blockchain technology can be a force for good, promoting transparency, accountability, and efficiency in various industries.

As for the environmental concerns, they’re real, but they’re also a catalyst for change. The crypto world is waking up to the need for sustainability, and this awakening is driving innovation. The shift to greener consensus mechanisms, carbon offsetting, and more sustainable practices are all promising signs.

In the end, the sustainability of cryptocurrencies depends on how well the community, developers, and enthusiasts embrace eco-conscious choices.

The future of crypto and sustainability is an exciting and evolving adventure. 🌱💰🌎

How do Beginners Invest in Cryptocurrency?

So, you’re intrigued by the world of cryptocurrencies and ready to take your first steps into this exciting digital realm.

Don’t worry; we’ve got your back. Here’s a step-by-step guide for novice investors who are taking their first dive into the world of cryptocurrency, all while keeping an eye on sustainability.

Step 1: Do Your Homework

Before you jump in, take some time to understand what you’re getting into:

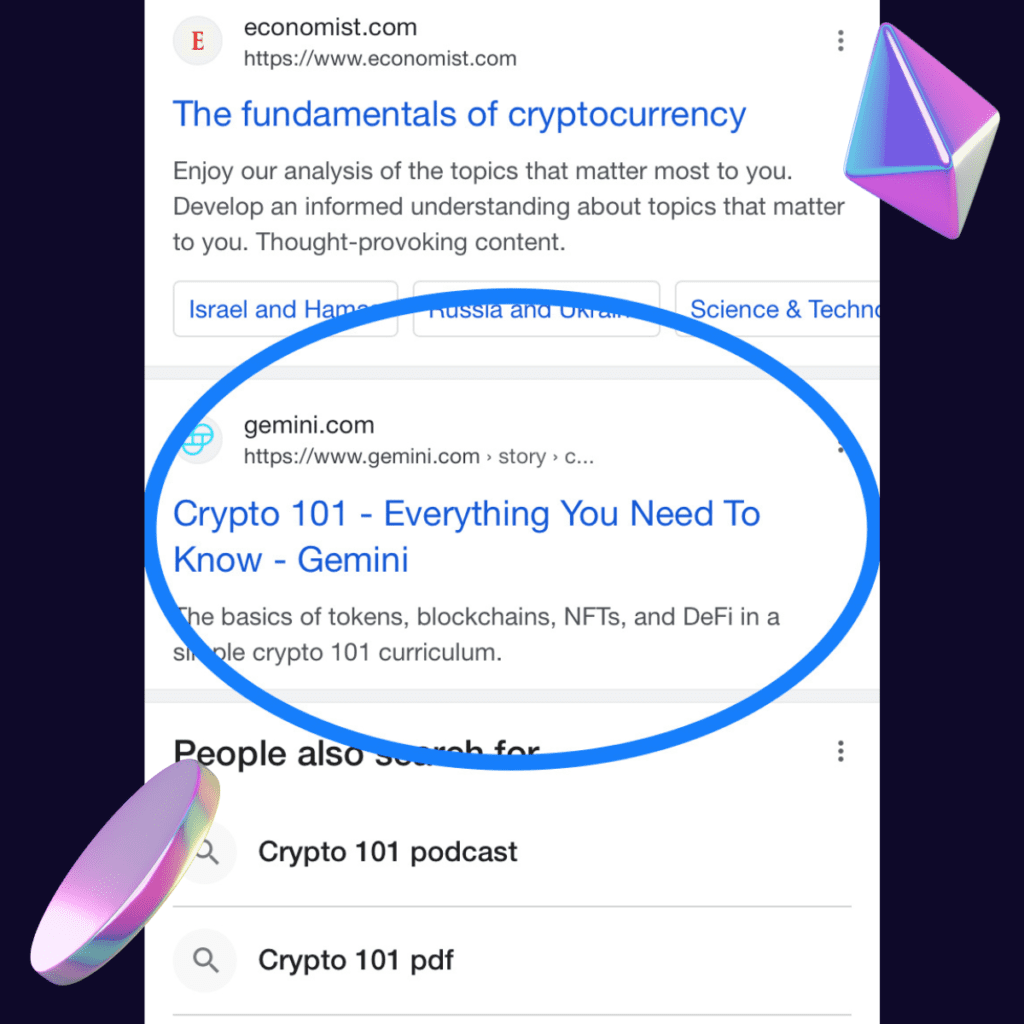

- Research: Learn about the basics of blockchain technology and how cryptocurrencies work. Tons of online resources and articles explain these concepts in simple terms.

- Risk Assessment: Understand that cryptocurrencies can be volatile. Be prepared for the ups and downs of the market and only invest what you can afford to lose.

Step 2: Choose a Crypto Exchange

It’s crucial to pick a cryptocurrency exchange that aligns with your values. You might want to consider opting for platforms that support sustainability:

- Research Exchanges: Explore different cryptocurrency exchanges to find one that promotes eco-friendly practices.

Cryptocurrency Exchanges

- Binance: One of the largest exchanges globally, offering a wide range of cryptocurrencies and trading options.

- Kraken: Known for its strong security features and commitment to eco-friendly practices, Kraken is a popular choice among sustainability-conscious traders.

- Coinbase: As a beginner-friendly exchange, Coinbase aligns well with newcomers and has a commitment to environmental sustainability.

- Bitstamp: With a focus on European users, Bitstamp is known for its robust security and transparent operations.

- Gemini: Founded by the Winklevoss twins, Gemini is committed to green energy solutions and transparency in its operations.

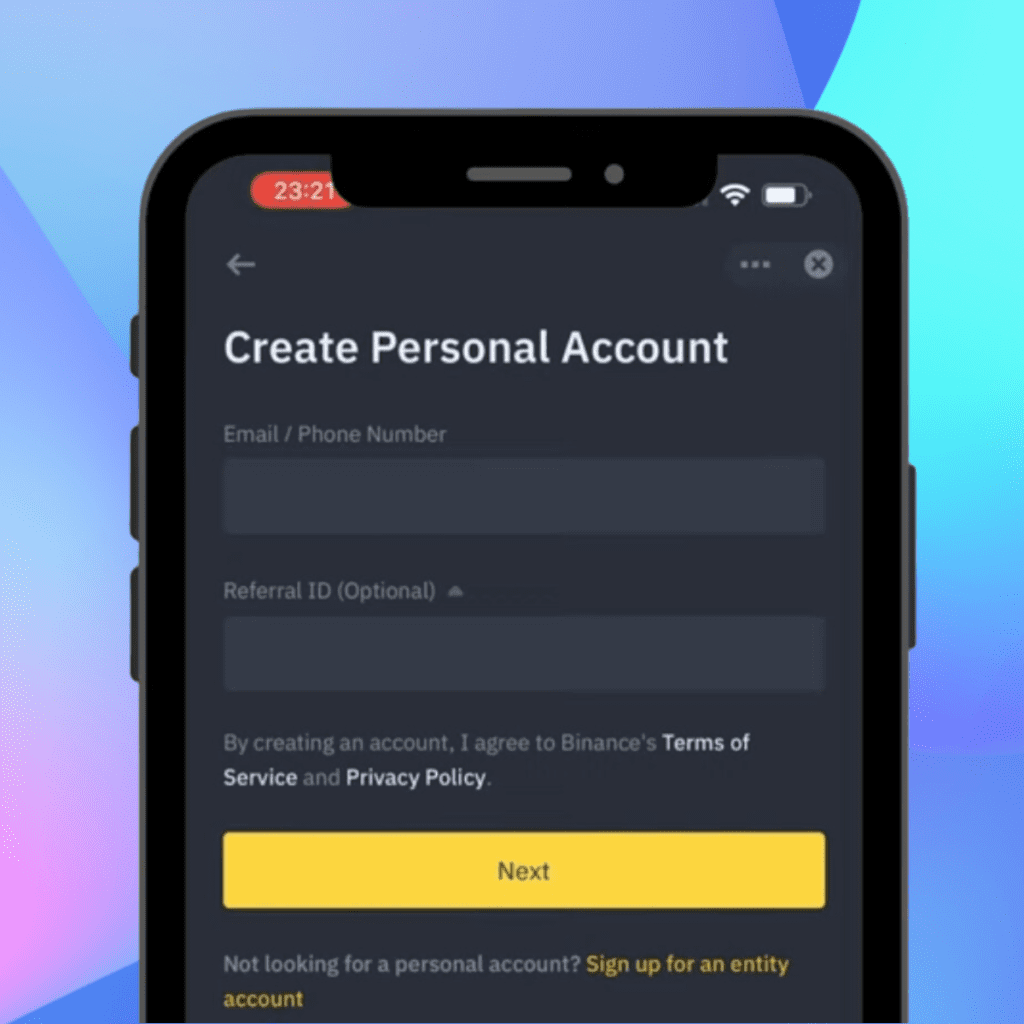

Step 3: Registration and Verification

Now, let’s dive into setting up your account on the cryptocurrency exchange. It’s essential to follow these steps carefully to ensure a smooth and secure start to your crypto journey:

Sign Up

To get started, you’ll need to create an account on your chosen exchange. This usually involves providing your basic personal information. Here’s how it works:

- Go to the exchange’s website and look for a “Sign Up” or “Register” button. Click on it to begin the process.

- You’ll be asked to provide information such as your name, email address, and sometimes your phone number. Make sure the email address you use is one you have access to and check regularly.

- Choose a strong and unique password for your account. This password should be hard for others to guess and should include a combination of letters, numbers, and symbols.

- You might also need to agree to the exchange’s terms and conditions, which include their policies on security, fees, and other important matters.

Verification Process

After you’ve signed up, it’s common for exchanges to ask for additional documents to verify your identity. This is a crucial step for security and compliance with regulations. Here’s what you can expect:

- The exchange may request documents such as a copy of your driver’s license or passport. Sometimes, they ask for a photo of you holding your ID to confirm that it’s really you.

- Ensure that the documents you provide are clear and in good condition. Make sure the information you provide matches the details you used to sign up.

- Follow the exchange’s instructions carefully and double-check that you’ve provided all the necessary information. Any errors or omissions could lead to delays in your verification process.

- Be prepared for the process to take some time. Exchanges often have to manually review your documents, which can sometimes result in waiting periods.

Why Verification Matters

Verification is a vital security measure for both you and the exchange. It helps prevent fraudulent activities and ensures that the funds you invest are protected. It’s also a requirement to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which are in place to safeguard the integrity of the financial system.

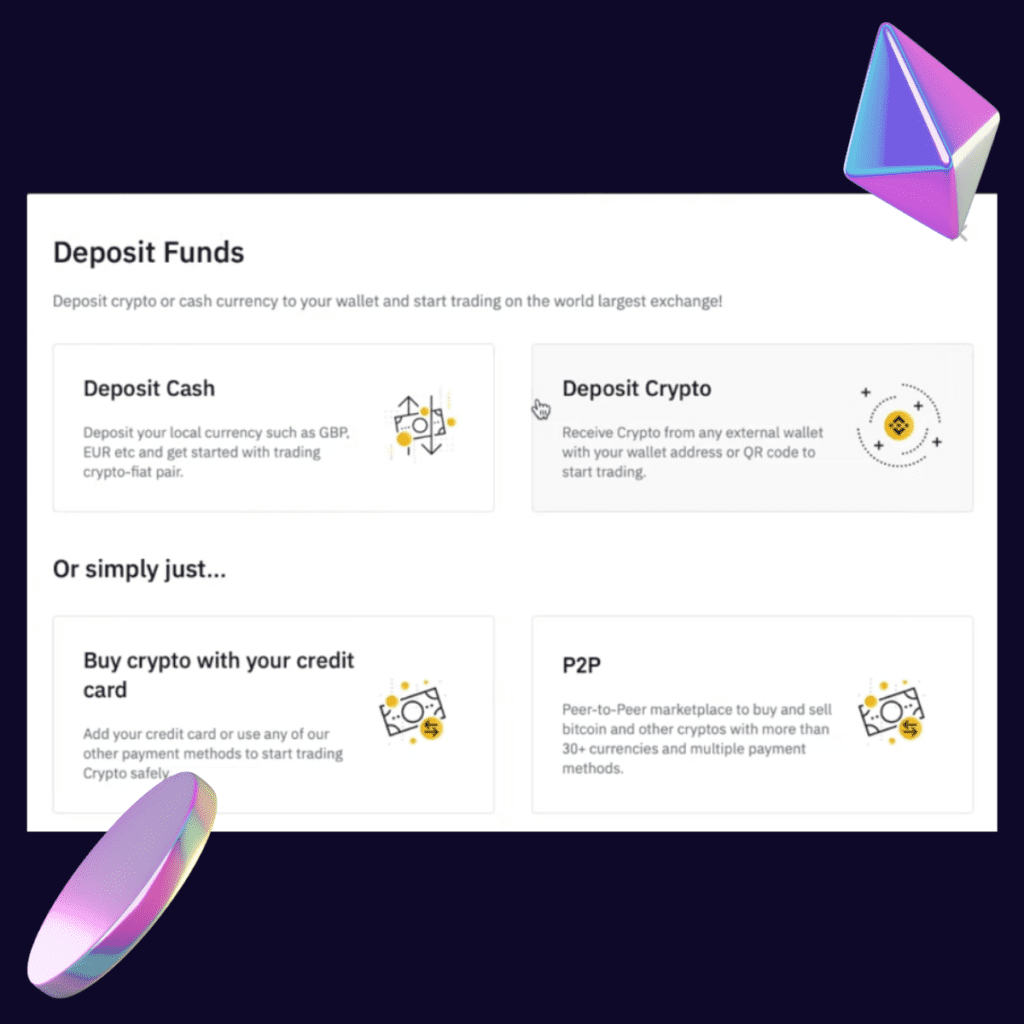

Step 4: Make Your First Deposit

It’s time to add funds to your account, and there are a couple of options to consider:

Payment Methods

When you’re making your deposit, you’ll have a range of payment methods to choose from:

- Bank Transfer: You can link your bank account to the exchange and transfer funds directly. This is a secure and often cost-effective method.

- Credit Card: Many exchanges accept credit card payments, which can be quick and convenient. Keep in mind that credit card purchases may involve additional fees.

- P2P (Peer-to-Peer) Transactions: P2P transactions are like the online marketplace of the cryptocurrency world. You can buy your digital coins directly from other individuals. It’s pretty cool because it offers a ton of flexibility. You can usually choose how you want to pay – bank transfer, online wallet, and more. Just make sure you’re dealing with trustworthy people to keep things on the up-and-up and avoid any potential hiccups.

- Cryptocurrency: If you already have some cryptocurrency, you can deposit it into your exchange account and use it to start trading.

- Stablecoin Conversion: Another strategy is to convert USD or EUR into a stablecoin like USDC or DAI. Stablecoins are designed to maintain a stable value, which can be helpful during volatile market conditions. Once you have stablecoins in your account, you can easily purchase other cryptocurrencies when the time is right.

By having these options, you can choose the method that best suits your preferences and financial situation.

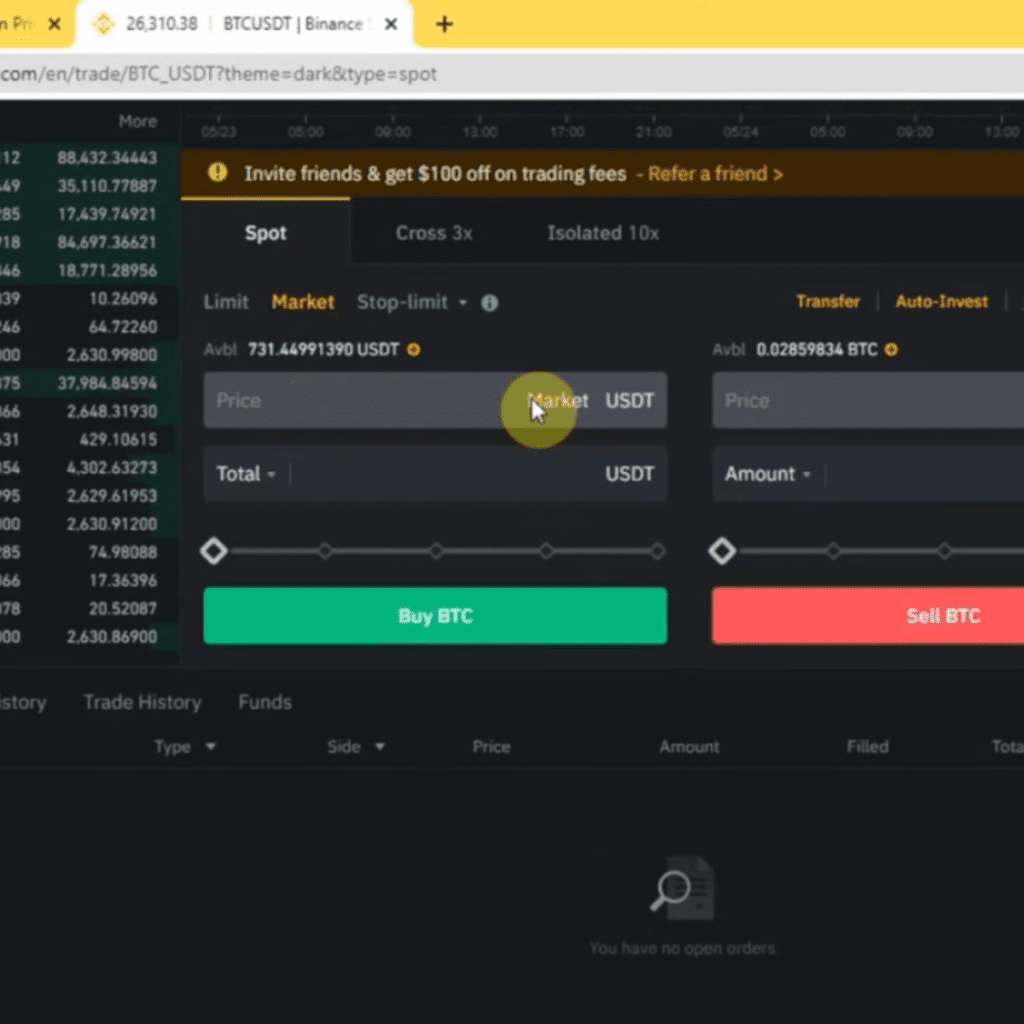

Step 5: Start Trading Cryptocurrency

You’re all set to make your first purchase:

- Select Your Coin: Choose the cryptocurrency you want to invest in. Bitcoin and Ethereum are popular choices for beginners. But we’ve provided you with a list of the top 10 most sustainable cryptos to look out for!

- Place an Order: Decide how much you want to buy and place your order. You can choose a market order (buy at the current market price) or a limit order (set your desired price).

Step 6A: Leave Cryptocurrency on the Exchange for Swing Trades

Sometimes, you might want to engage in more active trading, taking advantage of price fluctuations. Here’s how to do it:

- Swing Trading: Swing trading involves buying and selling cryptocurrencies over a short period to profit from price swings.

- Keep Funds on the Exchange: If you plan to swing trade, you can leave a portion of your funds on the exchange for faster access when making quick trades. However, it’s essential to keep this amount limited to what you’re comfortable risking.

- Secure Your Account: Be extra cautious with your exchange account’s security. Use two-factor authentication (2FA) and follow best practices to protect your assets.

Step 6B: Store Your Cryptocurrency in Wallets

For long-term safety and added security, consider moving the majority of your funds to your wallet:

- Secure Storage: Your wallet is like your treasure chest. Transfer the bulk of your cryptocurrency holdings to your wallet, especially if you’re not actively trading them.

- Cold Wallet for Savings: Consider using a cold wallet (hardware wallet or paper wallet) for long-term storage. They’re less vulnerable to online threats.

- Remember Backup: Always keep backup copies of your wallet’s recovery seed (those 12-24 words). This is your life-saver in case your wallet is lost or damaged.

Cryptocurrency Wallets

- Ledger Nano S: This hardware wallet is known for its security features, helping you keep your investments safe from cyber threats.

- Trezor Model T: Another reputable hardware wallet, Trezor, offers a user-friendly interface and strong security.

- Exodus: A user-friendly desktop wallet with a built-in exchange feature, allowing you to manage your portfolio easily.

- Coinbase Wallet: Known for its simplicity, Coinbase Wallet offers a mobile app for managing your cryptocurrencies.

- GreenWallet: As the name suggests, GreenWallet promotes eco-consciousness by offsetting carbon emissions from your wallet’s operations.

Step 7: Stay Informed and HODL

Now that you’re a crypto investor, here’s some wisdom to keep in mind:

- HODL: Don’t panic when the market gets bumpy. “HODL” is a common term in the crypto world that means holding onto your investment for the long term.

- Stay Informed: Keep up with cryptocurrency news and market trends. Knowledge is your best friend in this space.

Remember, investing in cryptocurrency can be both thrilling and challenging. It’s a journey where you learn and grow. So, dive in with caution, stay curious, and enjoy the ride. Happy investing, eco-conscious explorer! 🌱🚀💰

Is $100 Enough to Invest in Crypto?

So, you’ve got $100 burning a hole in your pocket, and you’re wondering if that’s enough to dive into the exciting world of cryptocurrency. The short answer is yes, absolutely!

Here’s a step-by-step guide, broken down into simple terms, on how to make the most of your $100 investment:

Step 1: Start Small and Stay Calm

- Begin with $100: Your $100 is a great starting point. It’s crucial to begin with an amount you’re comfortable with, and $100 is a perfect entry into the world of cryptocurrency.

- Avoid Overextending: Remember, you don’t need to buy a whole coin. You can invest in fractions of a cryptocurrency, so your $100 can go a long way.

Step 2: Embrace the Power of HODLing

- What Is HODLing? HODLing simply means holding onto your cryptocurrency for the long term. It’s like planting a little financial seed and watching it grow.

- Benefits of HODLing: By HODLing, you’re less affected by the day-to-day ups and downs of the market. It’s a strategy that’s proven to work over time.

Step 3: Explore Swing Trading

If the HODLing strategy isn’t speaking to you then you might want to consider swing trades:

- Swing Trading: Swing trading is like catching waves in the ocean. It involves buying low and selling high, but over a short period. You can make quick gains with this strategy.

- Swing Trading Tools: You can use tools like TradingView and indicators like the RSI to help you find the best time to buy and sell.

Step 4: Diversify Your Investments

- Don’t Put All Eggs in One Basket: With $100, it’s wise to invest in 2-3 different cryptocurrencies rather than putting everything into one. Diversification can help spread the risk.

- An All-In-One Strategy: If you prefer an all-in-one approach, you can consider investing in a cryptocurrency that offers a diversified portfolio within itself. For example, some cryptocurrencies are designed to track the performance of multiple assets, like Research Index Coins: Look for index coins like Crypto20 (C20) or Bitwise 10 Crypto Index Fund (BITW) that represent a basket of cryptocurrencies. By investing in these, you effectively diversify within a single coin.

Step 5: Learn as You Go

- Education Is Key: Keep learning about the cryptocurrency market. Read articles, follow the news, and stay informed.

- Start Small, Dream Big: Your $100 investment is just the beginning. As you learn and grow, you can consider adding more to your crypto portfolio.

Step 6: Stay Patient and Stay Safe

- Don’t Panic: The crypto market can be wild at times, but it’s essential to stay patient. Avoid rushing into decisions due to fear or excitement.

- Secure Your Investments: Ensure you’re using secure wallets and exchanges, and keep your private keys and passwords safe.

Step 7: Enjoy the Journey

- Have Fun: Investing in cryptocurrency is an adventure. Enjoy the process of learning and growing your investment.

- Dream Big: Who knows where your $100 could lead? Many successful investors started with small sums and saw their investments grow over time.

Remember, it’s not about how much you start with, but how you manage your investment and stay informed. So, have a blast in your crypto journey, and let your $100 be the beginning of an exciting financial adventure! 🚀💰😀

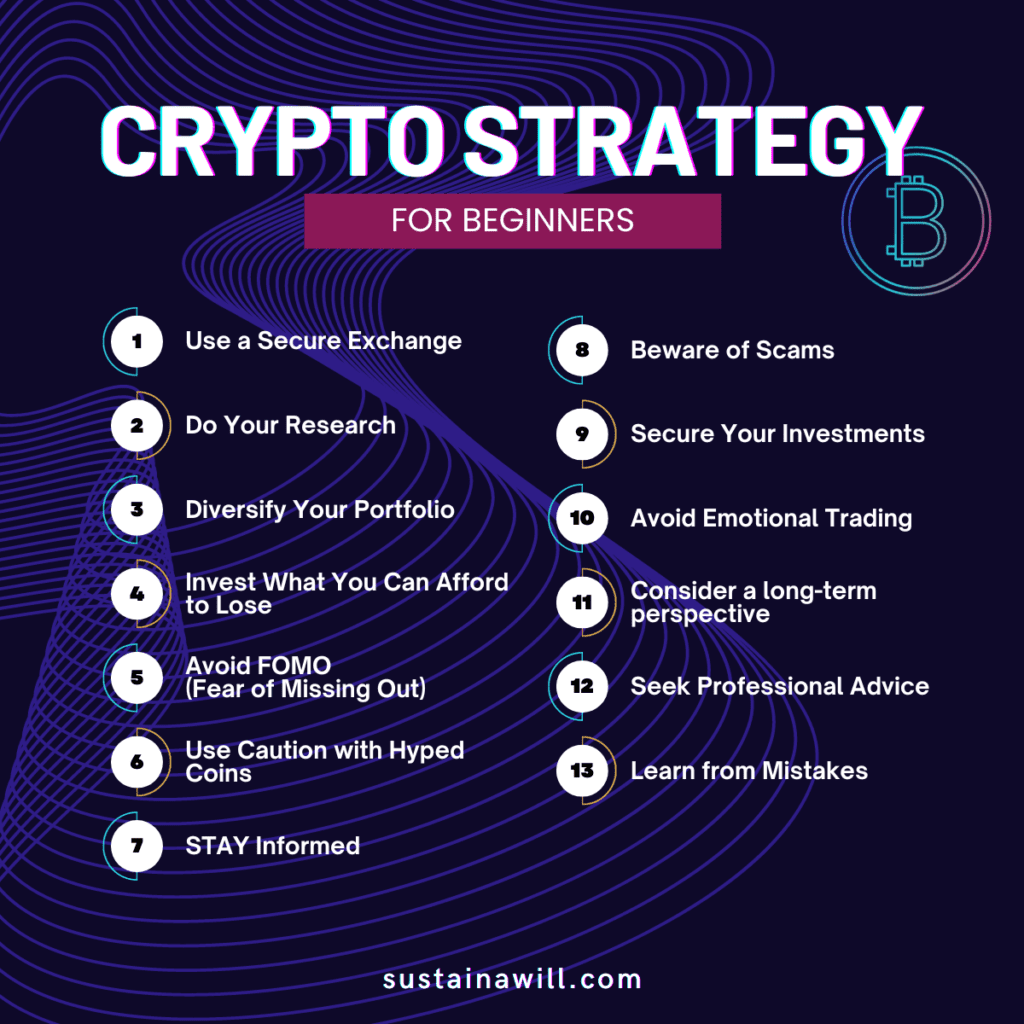

How to Safely Invest in Cryptocurrency

Ah, the world of cryptocurrency! While it’s an exciting space, it’s crucial to invest safely and wisely. Here’s a quick guide to help you navigate this thrilling yet sometimes unpredictable realm:

- Start with a Secure Exchange: Choose a reputable and secure cryptocurrency exchange. Look for platforms that prioritize security, offer two-factor authentication (2FA), and store the majority of customer funds in cold storage wallets.

- Do Your Research: Never invest in a cryptocurrency without understanding what it is and how it works. Research the project, its team, technology, and use cases. Don’t rely on hearsay or rumors.

- Diversify Your Portfolio: Don’t put all your funds into one cryptocurrency. Diversification can help spread risk. Consider investing in a few different assets to minimize potential losses.

- Invest What You Can Afford to Lose: Never invest money you can’t afford to lose. Cryptocurrency markets can be highly volatile, and it’s essential to only invest funds that won’t affect your day-to-day life.

- Avoid FOMO (Fear of Missing Out): FOMO can lead to impulsive and emotional decisions. Instead of chasing prices during a sudden surge, take your time and make informed choices. Create a well-thought-out trading strategy that includes entry and exit points, stop-loss levels, and profit targets. Stick to your plan, and avoid deviating from it due to FOMO.

- Use Caution with Hyped Coins: Coins that receive a lot of hype can be enticing, but they can also be risky. Don’t rush into investments based solely on popularity. Evaluate the fundamentals.

- Stay Informed: Keep up with the latest news and developments in the crypto space. This knowledge will help you make informed investment decisions.

- Beware of Scams: Be cautious of offers that seem too good to be true. Scammers often target the crypto community. Don’t share your private keys, and be skeptical of unsolicited messages.

- Secure Your Investments: Use hardware wallets or other secure storage methods for long-term holdings. Keep your private keys and passwords safe. Be wary of phishing attempts.

- Avoid Emotional Trading: Emotional trading, driven by fear or greed, can lead to poor decisions. Stick to your investment strategy and don’t panic during market fluctuations.

- Long-Term Perspective: Consider a long-term perspective. Cryptocurrency investments can take time to mature. Patience can often yield better results.

- Seek Professional Advice: If you’re uncertain about your investment strategy, consider seeking advice from financial professionals who have experience in the crypto space.

- Learn from Mistakes: It’s possible to make mistakes in the crypto market. If you do, view them as valuable lessons and opportunities for growth.

Remember, cryptocurrency investment is a journey, not a sprint.

By following these guidelines and staying informed, you’ll be better equipped to navigate the crypto landscape while protecting your investments.

Stay cautious, curious, and patient, and you’ll be on your way to becoming a confident crypto investor! 🌟🚀💰

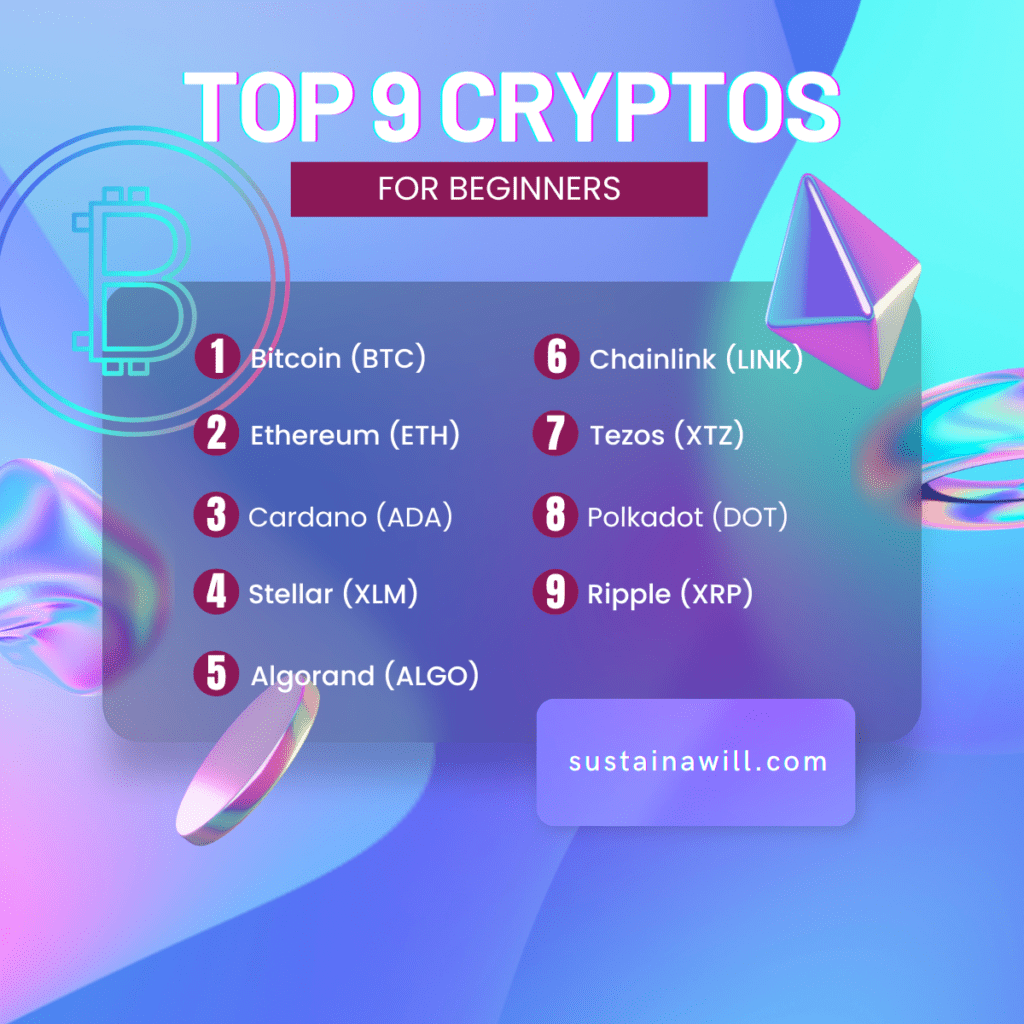

Which Cryptocurrency Is Best for Beginners?

When it comes to choosing the best cryptocurrency for beginners, it’s essential to consider the following:

- Widely Recognized: Coins with a strong reputation and recognition in the crypto space.

- Sustainability: Coins using energy-efficient consensus mechanisms like proof of stake (PoS).

- Technological Innovation: Projects that offer unique and valuable features.

- Ecosystem and Use Cases: Coins with a growing ecosystem and various applications.

- Security and Reliability: Emphasis on safety and robust infrastructure.

- Community Support: Coins with an active and engaged community.

- Long-Term Viability: Coins with a vision for the future and a clear roadmap.

- Responsible Development: Coins that are committed to responsible practices and sustainability.

1. Bitcoin (BTC): The Pioneer

- Despite the serious sustainability concerns, Bitcoin is undeniably the best coin for crypto beginners. It’s the first cryptocurrency, widely accepted, and relatively stable compared to some alt-coins with crazyyy movements.

- Sustainability: Bitcoin’s environmental impact has raised serious concerns due to its energy-intensive mining process. However, this has started serious discussions about transitioning to more eco-friendly mining methods in the near future.

2. Ethereum (ETH): Smart Contracts and Sustainability

- Ethereum is known for its smart contract capabilities, making it a valuable choice for projects and developers.

- Sustainability: Ethereum is undergoing a transition from a proof-of-work (PoW) to a proof-of-stake (PoS) blockchain, which is more energy-efficient.

3. Cardano (ADA): A Sustainable Option

- Cardano has gained recognition for its commitment to sustainability and peer-reviewed research. It offers features like staking and smart contracts.

- Sustainability: Cardano uses a PoS system, significantly reducing its energy consumption compared to PoW blockchains.

4. Stellar (XLM): Focus on Financial Inclusion

- Stellar is designed for fast, cross-border transactions and has a mission to make financial services accessible to everyone.

- Sustainability: Stellar’s energy-efficient network aligns with sustainability goals.

5. Algorand (ALGO): High Performance and Sustainability

- Algorand is known for its high performance, security, and scalability. It offers staking rewards for holders.

- Sustainability: Algorand uses a PoS mechanism, making it a sustainable choice.

6. Chainlink (LINK): Oracle Solutions

- Chainlink provides decentralized Oracle solutions, connecting smart contracts to real-world data.

- Sustainability: While not inherently focused on sustainability, Chainlink operates on the Ethereum network, which is transitioning to PoS.

7. Tezos (XTZ): Self-Amending Blockchain

- Tezos is a self-amending blockchain with an on-chain governance mechanism.

- Sustainability: Tezos operates on a PoS model, reducing its carbon footprint.

8. Polkadot (DOT): Interoperability and Sustainability

- Polkadot aims to enable different blockchains to work together and offers staking rewards.

- Sustainability: Polkadot uses a PoS system, contributing to sustainability.

9. Ripple (XRP): The Ledger Ecosystem

- XRP is designed for fast, low-cost cross-border payments and is used within the Ripple ecosystem.

- Sustainability: XRP stands out as eco-friendly because it doesn’t rely on energy-intensive mining processes like Bitcoin.

- XRP (XRP) uses a consensus mechanism known as the XRP Ledger Consensus Protocol or XRPL Consensus Protocol. It’s different from the energy-intensive Proof of Work (PoW) mechanism used by cryptocurrencies like Bitcoin. The XRPL Consensus Protocol is designed to be more energy-efficient and faster, making it a more sustainable choice.

Is XRP Eco-Friendly?

Yes, XRP is considered eco-friendly! It’s known for being efficient and not consuming as much energy as some other cryptocurrencies. This makes it a more sustainable choice for those who are environmentally conscious.

Sustainability not only benefits the planet but also supports the long-term viability of the crypto space.

Always conduct thorough research and consider seeking professional advice when making your decision. Happy investing! 🚀💼💰

Conclusion: Building a Responsible Crypto Portfolio

Congratulations! You’ve embarked on a journey into the exciting world of cryptocurrency. As you wrap up your exploration, here are some key takeaways to guide you in creating a responsible crypto portfolio:

1. Define Your Goals: Start by defining your investment goals and risk tolerance. Knowing what you want to achieve will help shape your portfolio.

2. Prioritize Sustainability: Consider cryptocurrencies that align with sustainability values. Look for eco-friendly options and projects committed to responsible practices.

3. Diversify Your Investments: Spreading your investments across different cryptocurrencies can help manage risk and enhance potential rewards.

4. Stay Informed: Keep yourself updated with the latest news and developments in the crypto space. Knowledge is your best ally.

5. Invest Wisely: Never invest money you can’t afford to lose, and avoid emotional decisions. Patience and a rational approach are your best friends.

6. Seek Professional Advice: If you’re unsure about your investment strategy, don’t hesitate to seek advice from financial professionals with expertise in cryptocurrencies.

Create Your Responsible Crypto Portfolio:

Now, it’s time to take these insights and start building a portfolio that aligns with your financial goals and values. Whether you’re aiming for long-term growth or looking for sustainable options, the crypto market offers diverse opportunities.

Remember, investing responsibly not only benefits you but also contributes to the sustainable future of the crypto space.

So, go ahead, create your crypto portfolio, and watch it grow while making a positive impact. Your financial journey has just begun! 🌱🚀💰