Ever wondered about Susu and how it could benefit you? Maybe you’re thinking, “How reliable is it, and can it keep up with the times?”

Well, stick around. In this easy guide, we’ll break down what Susu is, how it works, and show you modern twists like Braid.

Reading on will clear up any doubts and have you ready to harness the power of community-driven financial success. Let’s dive in!

What is a Susu?

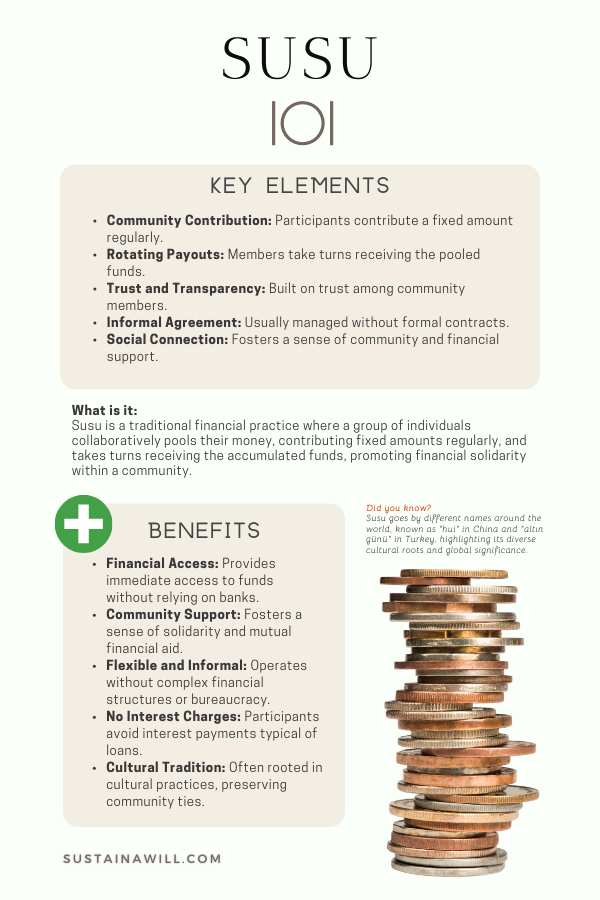

“Susu” is a fascinating savings and investment concept that has its roots in West Africa but has spread across cultures globally. A close-knit group—perhaps friends, family, or community members—comes together to pool money.

Here’s the deal:

- Team Up: You and your group decide to pool in money regularly.

- Contribute: Each member puts in a fixed amount regularly, like weekly or monthly.

- Rotation Magic: The total collected cash goes to one member at a time in a set order. It’s a bit like taking turns.

- No Interest, Just Support: Unlike a typical savings account, there’s usually no interest involved. Instead, you get access to a lump sum when it’s your turn. Need money for something specific? This could be a game-changer.

- English Terms: In English, you might hear these setups referred to as “partner hand” or “money-saving group,” capturing the essence of pooling resources for mutual benefit.

So, whether it’s called susu, hui (China), altın günü (Turkey), or another name, it’s a community-powered way to financially support each other. Cool, right?

How does Susu work?

Let’s break down how a Susu works step by step:

- Formation of the Group:

- You and your friends decide to form a Susu group. There are 5 of you.

- You agree that each person will contribute $100 every month.

- Contributions:

- Every month, each member contributes $100, creating a pool of $500.

- Rotation Schedule:

- You decide on a rotation order. Member 1 gets the money in the first month, Member 2 in the second month, and so on.

- Payouts:

- In the first month, Member 1 receives the entire $500.

- The next month, it’s Member 2’s turn, and they receive the $500.

- No-Interest System:

- There’s no interest involved. Members are simply taking turns receiving the pooled funds.

- Commitment and Trust:

- Commitment is crucial. Everyone needs to contribute $100 each month for the system to work.

- Supportive Community:

- This $500 lump sum can be used by each member for various purposes, like starting a small business, paying bills, or saving for a specific goal.

So, it’s like having a shared savings account where each member gets a chance to use the pooled funds. The rotation ensures that everyone reaps the rewards, fostering a supportive financial community aligned with principles of mindful consumption and sustainable living.

How Do I Start a Money-Saving Group (Susu)?

Starting a money-saving group, or Susu, can be a great way to build financial support within your community.

Here are some tips to get you started:

- Assemble Your Group:

- Gather a group of trustworthy friends, family, or community members who are interested in participating.

- Ensure that everyone is on board with the idea and willing to commit to regular contributions.

- Define Contribution Terms:

- Decide on the amount and frequency of contributions. For example, you might agree on $50 per week or $200 per month.

- Clearly communicate the rules, including how payouts will be structured and the rotation order.

- Set Up a Rotation Schedule:

- Establish a fair rotation schedule to determine the order in which members will receive the lump sum.

- Make sure everyone understands the schedule and is comfortable with their designated payout months.

- Build Trust and Commitment:

- Emphasize the importance of commitment and trust among group members. The success of a Susu relies on everyone fulfilling their contribution obligations.

- Keep Clear Records:

- Maintain transparent and accurate records of contributions, rotations, and payouts. This helps in avoiding misunderstandings and ensures a smooth process.

Is There a Susu App?

Yes, some tools can help you manage your Susu group more efficiently. One such platform is Braid.

Braid: A New Way to Manage Money with Friends and Family

- What is Braid? Braid is a platform that offers Braid Pools, a modern approach to collecting, managing, and spending money with your close ones.

- How Does it Work? After creating a Braid Pool, you can invite others to join. Members can contribute directly to the pool, simplifying the process.

- Shared Money Management: Braid Pools are designed for both one-off and ongoing shared expenses. It provides a centralized space for your shared money.

- Coming Soon -> Pool Debit Cards: Braid is planning to introduce pool debit cards, allowing you to spend directly from your pool for added convenience.

Learn more about Braid Pools: Braid Website

Using a platform like Braid can streamline the administration of your Susu group, making it easier to track contributions and manage payouts. A modern twist on a traditional concept, bringing financial collaboration into the digital age.

Why do people do Susu?

Now, you might be wondering why people are into Susu, right?

Well, there are some pretty cool advantages to it:

- Community Power:

- Susu brings people together, creating a supportive community. It’s like having a financial team cheering you on.

- Get That Lump Sum:

- You get access to a lump sum of money when it’s your turn. Perfect for tackling specific goals or unexpected expenses.

- No Interest Hassle:

- Unlike loans or credit cards, Susu doesn’t involve interest. Contribute and receive funds without worrying about extra charges.

- Flexibility in Savings:

- Use your lump sum for anything – starting a business, education, or handling surprise costs. It’s your money for your goals.

- Everyone’s In:

- Susu is inclusive, especially for those without access to traditional banking. It’s a financial platform for everyone.

- Cultural Ties:

- It’s not just about money; Susu is often deeply rooted in culture. Strengthen social ties while boosting your finances.

- Saving Structure:

- Susu helps you build good saving habits. Commit to regular contributions, and watch your savings grow.

- Share the Risk:

- The financial risk is spread across the group. Everyone pitches in, and everyone benefits.

- Adapt to Your Needs:

- Susu works whether you’re a small family or a larger community. It’s flexible and fits your scale.

- Keep It Simple:

- Susu is straightforward. Minimal fuss, minimal hassle. Easy to manage, easy to benefit from.

So, if you’re thinking about Susu, consider the awesome perks it brings – from financial gains to community bonds. It’s not just saving money; it’s a way to thrive together.

What are the disadvantages of Susu?

Alright, let’s talk about the flip side. Susu has its perks, but there are some downsides too.

Here’s the lowdown:

- Dependence on Others:

- Your Susu success depends on the reliability of others. If someone falls through on their contributions, it can affect the entire group.

- Limited Financial Growth:

- Since Susu typically doesn’t involve interest, your money might not grow as much as it would in a traditional savings account or investment.

- Potential for Disputes:

- Without clear rules and documentation, misunderstandings can arise. Disputes within the group might jeopardize the trust and camaraderie.

- Informality Brings Risks:

- In some places, Susu operates in a legal gray area. Operating in an informal setting can pose risks if issues arise.

- No Safety Net:

- Unlike formal financial institutions, Susu doesn’t provide the same level of security. There’s no insurance or protection for your contributions.

- Pressure to Contribute:

- If you face financial difficulties during your payout month, the pressure to contribute might strain your personal finances.

- Limited Financial Services:

- Susu doesn’t offer the range of financial services you’d find in a bank. It’s focused on savings and payouts, missing out on other benefits.

- Limited Flexibility:

- The fixed contribution schedule might be a drawback if your financial situation changes. Life happens, and sticking to a rigid plan can be challenging.

- Potential for Exclusion:

- In some cases, Susu groups might unintentionally exclude certain individuals, limiting access to those who could benefit.

- Dependency on Rotation:

- If your payout turn comes at a time when you don’t have a specific need, the lump sum might not be as beneficial.

Remember, every coin has two sides. While Susu has its challenges, being aware of them and finding ways to address potential issues can help you make the most of this traditional financial approach. It’s all about balance and understanding the dynamics of your Susu group.

Conclusion

In closing, Susu isn’t just a concept; it’s a financial game-changer. Ready to turn the power of community into your financial advantage?

Your Move

- Form a Trustworthy Crew:

- Gather reliable members to make your Susu rock-solid.

- Blend Tradition with Tech:

- Explore modern platforms like Braid for a seamless Susu experience.

- Navigate Smartly:

- Understand legal aspects, formalize agreements, and consider formal financial options when needed.

Now, Take Charge

Your financial journey with Susu starts now. Gather your squad, explore new avenues, and let the power of community elevate your financial game. Ready to make it happen? Dive in!